The theory of peak oil — the point at which the Earth’s oil supply begins to dwindle — was a hot and debatable topic last decade. There are lots of signs that we are at a technology demand peak. Is this permanent, or how will we get past this peak?

The last-decade argument that oil production had permanently peaked proved to be laughably incorrect. Hydraulic fracturing (“fracking”) technology developed in the United States changed the slope of the oil production curve upwards. This analyst has no intention becoming a laughing stock by suggesting that digital technology innovation has peaked. Far from it. However, few things in nature are a straight line; it certainly appears that digital technology adoption — demand — has slowed. We are in a trough and can’t foresee the other side.

One good place to look for demand forecasts is the stock market.

Smart Phones and Tablets

Last month, both gadget profit-leaders Samsung and Apple both took hits based on slower growth forecasts. “Pretty much everyone who can afford a smartphone or tablet has one, so where does the profit growth come from?” was the story line. Good question.

This month, AT&T and T-Mobile announced they would lease customers smartphones instead of selling them outright with a carrier discount. The phones and tablets coming off lease will be re-sold into the burgeoning used gadget market. It’s now too easy to get new-enough gadget technology in the used market. After all, your last-year’s hardware can still run this year’s free, new software upgrade.

On the surface, it appears that the global market for $600 smartphones and tablets is at or close to saturation — a peak.

Desktop and Notebook PCs

The stock market is not treating traditional technology makers very well. H-P is coming back from a near-death experience. Its stock is half what it was two years ago. Dell wants to go private so it can restructure and deal with market forces that are crushing margins and profits. Even staid and predictable IBM has lost its mojo over the past five quarters. Microsoft missed.

These technology makers are dealing with PCs, the data center, and services. They are not major players in the smartphone/gadget market. Their focus is on doing what they used to do more efficiently. That strategy is not working.

The desktop and notebook PC markets are almost all replacement units in developed countries. Macro-economics has dramatically slowed emerging market growth in formerly hot places like Brazil, Russia, India, and China (BRIC). The new customers are being added more slowly and at higher costs, and existing customers have increasingly voted to not upgrade as frequently. My 2008 Apple MacBook Air, cutting edge and quite expensive at the time, is still adequate for road trips. My Sandy Bridge Generation-1 Ultrabook has adequate battery life. There’s no compelling reason, most buyers tell us, to accelerate the PC replacement cycle.

Well, one temporary accelerator is the support demise next year for Windows XP. With auditors and consultants screaming about liability issues, non-profits and government are rolling in new PCs to replace their ten-year old kit. Thank goodness. But seriously, ten-year old PCs have been getting the job done, as defined by user management.

Note also that a new PC likely means a user-training upgrade to Windows 8. Both consumers and businesses are avoiding this upgrade more or less like the plague. There is no swell of press optimism that Windows 8.1 this fall will be the trick. PC replacement is a pain already, so few want to jump on an OS generation change as well.

Data Center

The data center market shows some points of light. Public cloud data centers by the big boys like Apple, Google, Facebook, and Amazon are growing like gangbusters. High Performance Computing, where ever more complex models consume as many teraflops as one can afford to throw at the problem. Recent press reports suggest that “national security” is a growing technology consumer. [understatement]

However, enterprise data centers, driven by cautious corporate management, are growing more slowly than five years ago; this market outsizes the points of light. Moreover, the latest generation of server technology really does support more users and apps than the gear being replaced. With headcount down and fewer new enterprise apps, fewer racks are now getting the computing workload done. (Storage, of course, is growing logarithmically). We also expect a growing trend towards “open computing” servers, a trend that will suck hardware margin and services revenue from the big server-technology makers.

Navigating From the Trough

So, mobile gadgets, traditional PCs, and the data center — the three legs of the digital technology stool — are all growing more slowly than in the recent past. This is the “technology demand peak” as we see it. We are presently past the peak and into the trough.

How deep is the trough and how long will it last? LOL. If we knew that, we could comfortably retire! Really, there are roughly a couple of trillion dollars in market cap at stake here. If the digital tech market growth remains anemic beyond another twelve months, then there will be too many tech players and too few chairs when the music stops. Any market observer can see that.

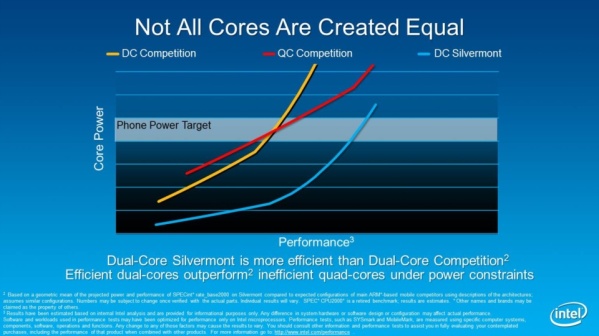

Our own view is that it will take a number of technology innovations that will propel replacement demand and drive new markets. The solution is new tech, not better-faster-smaller old tech. Where’s the digital equivalent of fracking? (Actually, fracking would not be possible without a lot of newly invented, computer-based technology.)

First, the global macro-economic slowdown is likely to resolve itself positively, perhaps soon. We don’t buy the global depression arguments. There are billions of potential middle-class new computer consumers and the data center backend to support them.

Next, mobile gadgets and PCs are on the verge of exciting new user interfaces. Things like holographic 3D displays — you are in the picture, and keyboards projected on any flat surface. Conference-room projection capabilities in every smartphone. New users interfaces, shared with PCs and notebooks, that are based on perceptual computing, the (wo)man-machine interface that recognizes voice, gestures, and eye movement, for starters.

Big data and the cloud are data-center conversation pieces. But these technologies are really toddlers, at best. Data-sifting technologies like the grandson of Hadoop will enable more real-time enterprise intelligence and wisdom. HPC has limits only of money available to invest. Traditional data centers will re-plumb with faster I/O, distributed computing, and the scale-up and scale-down capacity of an electric utility — while needing less from the electrical utility.

We don’t have all the answers, but are convinced it will take an industry kick in the pants to get us towards the next peak. More of the same is not a recipe for a solution. We are in a temporary downturn, not just past peak technology.

Your thoughts and comments are welcome.

Photo Credit: Eugene Richards