The IRS told Congress yesterday that two years of emails on Tax Exempt Organizations department manager Lois Lerner’s desktop were irretrievably lost due to a hard drive crash in 2011. As this is a technology blog, how could this event happen?

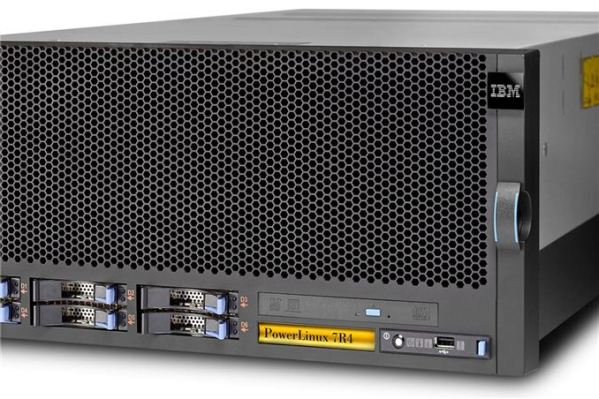

The Internal Revenue Service has 90,000 employees working in a complex financial-services organization. Like its private-sector counterparts, the IRS has a sophisticated Information Technology organization because the IRS mission is implementing the tax laws of the United States. The IRS is the epitome of a paper-pushing organization, and by 2011 paper-pushing was done by email.

1. The IRS first installed Microsoft’s enterprise email product, Exchange in the data center and Outlook on client desktops in 1998, about the same time as many Fortune 500 organizations. By 2011, the IRS had over a decade of operational experience.

2. Hard drives are the weak-link in IT installations. These mechanical devices fail at the rate of about 5% a year. With 90,000 employees, that works out to an average of 4,500 a year or 22 per work day. The IRS IT staff is very familiar with the consequences of user-PC hard drive failures. Data center storage management is another leaf in the same book.

3. The IRS reported to Congress that senior executive Lerner’s hard drive failed, and nothing could be recovered from it. It was forensically tested. As a result, the IRS claims, there is no record of the emails that were sent or received from Ms. Lerner’s computer. The thousands of emails recovered to date were extracted from sender or recipient email lists within the IRS, not from Lerner’s files. There is no record of emails to other federal departments, or to other organizations or personal emails.

4. The implication is that the Lerner email history only resided on her computer. There is no other IT explanation. Yet Microsoft Exchange in the data center stores copies of all email chains on multiple hard drives on multiple, synchronized email servers. That’s the way all enterprise email systems have to work. So the facts as stated make no IT sense.

But let’s look at the implications of a strategy where the Lerner email history only resided on her computer and the hard drive failed completely so nothing could be recovered:

- Where are the Lerner PC backups? With a 5% annual failure rate, industry-wide PC backup strategies are as old as centralized email. There should be Lerner PC backups made by IRS IT. Leave it up to the user to make backups? No organization the size of the IRS allows that for all the obvious reasons that come to mind, starting with it doesn’t work in practice.

- How could Lois Lerner do her work? The hard drive was lost and there were no PC backups. Besides losing two years worth of emails, GS-15 department head Lerner had to also lose all the data of a digital business life: calendar; contacts; personnel notes; work-in-process plans, schedules, meeting notes, reviews, budget spreadsheets, official IRS rulings.

It is inconceivable that a modern executive could be stripped of all her business data and not face-plant within a week. Could you? Not me. Nobody has paper backup for everything anymore. Your business smartphone backs up to your PC. - The Exchange servers log every email coming into and going out of the IRS. Did the whole set of IRS backup tapes fail in an unreported catastrophe? That primary (but undiscovered) failure would make the routine failure of Lerner’s PC unrecoverable.

I cannot think of an acceptable reason for the unexplained yet unrecoverable loss of the data on Lerner’s PC while following the usual practices every IT organization I have worked with over decades. Which leaves only two alternatives: a much clearer explanation from IRS IT professionals of how these events could happen; or something nefarious is going on.

Follow me on Twitter @peterskastner

The author’s experience with federal email and records management began with the Ronald Reagan White House in 1982.